Do you have a spouse, young children and are responsible for their well-being?;

Are your parents older or do you have a disabled person in the family?;

Is your retirement pension too low to maintain your family's standard of living if you were not there?;

Need capital to mount a separate project or for private use and insurance can help you get it?

If you answered yes to one or more of these questions you can think of insurance for tranquility of you and your family.

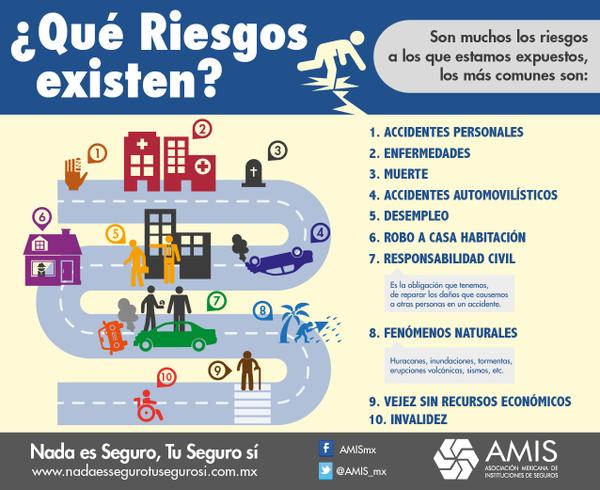

We are all exposed to an unforeseen event: illness, accident, natural phenomena, etc.

When this happens, our assets and even our lives are in danger. Perhaps the most terrible thing for a family head is to see that his family is in a situation that distresses them and that they cannot handle.

Preventing the harm we can do to our loved ones is the reason to have an insurance.

Acquiring an insurance we give a gift of love: The tranquility of our loved ones

Why buy health insurance if we have Seguro Popular, IMSS, ISSSTE, Pensiones, etc.?

Puede implicar un desequilibrio financiero muy fuerte para ti y tu familia en caso de que se tenga una enfermedad grave como puede ser el COVID-19 and that the social security system does not have the capacity to assist you with opportunity. Every time we are suffering more from chronic and degenerative diseases such as diabetes, cancer, hypertension, obesity, etc.

They are diseases for a LIFETIME, don't let them to surprise us ... One million pesos is a lot of money to have it in a bank account, however, to pay medical bills is none.

Acquiring an insurance policy, you are paying money now to protect yourself against financial losses ... and to provide financial stability to your family and / or business.

- In some cases, insurance is purchased hoping it will never be needed.

Collision damage insurance for a new car is one example.

No one buys car insurance expecting to have an accident and have to file a claim.

When there is an accidental death and we are held unintentionally responsible for that event.

- In other cases, insurance is purchased because it is already known that it will be needed, but it is not known when.

The best example is life insurance, which is paid to beneficiaries after the insured's death. While it is perfectly reasonable to expect to live for a long time, it must also be recognized that sad events sometimes happen unexpectedly that can seriously affect our loved ones, including a financial impact.

The possibility of having to pay an invoice of several thousand pesos justifies the investment in the purchase of insurance.